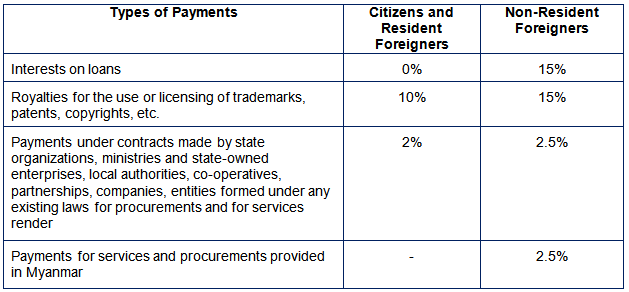

On 18th June 2018, the Ministry of Planning and Finance (“MOPF”) issued the Notification No. 47/2018 to replace the Notification No. 51/2017 on Types and Rates of Withholding Tax (“WHT”) effective from 1st July 2018. The new rates of the WHT are as follows:-

The minimum amount for deduction of the WHT has been changed to MMK1 million for the total payments within one year. If the WHT has already been paid in Myanmar, a Certificate of Domicile of Non-Resident Foreigner can be obtained from the Tax Office to avoid double taxation in home country of the non-resident foreigner.

AUTHOR

Partner | yangon

Partner | yangon |-

|-

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.

Corporate / M&A