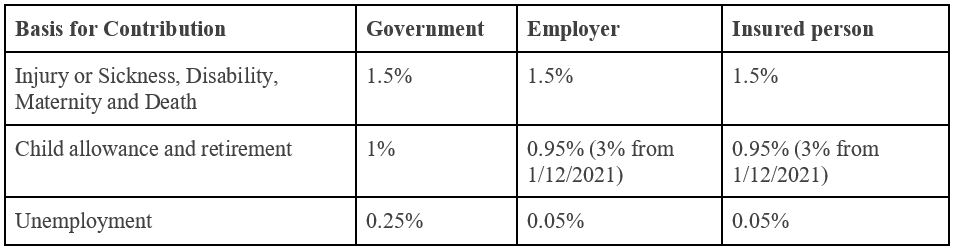

On 27th September 2021, the Ministry of Labour issued its Ministerial Regulation on Rates of Contributions to the Social Security Fund under the Social Security Fund Act B.E. 2533 (A.D. 1990) to set out new social security fund contribution rates in response to the Covid-19 pandemic. The objective of the new rates is to reduce the contribution burdens of the Government, the employer, and the employee (the insured person). The new rates replace their predecessors re-troactively effective from 1 September 2021. The new contribution rates are shown in the table below. They are based on the monthly base salary of the employee, subject to the maximum amount of the base salary to be used as the basis for calculating the contribution amounts is THB15,000.

To see the archive of our past newsletters and articles pleas click here.

AUTHOR

Senior Partner | bangkok

Senior Partner | bangkok Associate | bangkok

Associate | bangkok

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.