The Anti-Money Laundering Act B.E. 2542 (1999) of Thailand as amended (“AMLA”) and the regulations issued under the AMLA apply not only to financial institutions but also to non-financial institutions who are professional operators (“POs”) under the AMLA. This article discusses the duties of POs under the AMLA and its key regulations listed below:

(a) the Ministerial Regulation No. 4 B.E. 2543 (A.D. 2000) issued under the AMLA dated 11th September 2000 (“MR No. 4”);

(b) the Ministerial Regulation on the Amounts of Cash Transactions that Professional Operators as Prescribed in Section 16 Must Report to the Anti-Money Laundering Office (“AMLO”) B.E. 2554 (A.D. 2011) dated 19th May 2011 (“MR on Cash Transaction”);

(c) the Ministerial Regulation on Customer Due Diligence B.E. 2563 (A.D. 2019) dated 29th April 2019 (“MR on CDD”); and

(d) the Ministerial Regulation B.E. 2562 (2019) on Transactions that Financial Institutions and Professionals under Section 16 Must Require Customers to Identify B.E. 2562 (A.D. 2019) dated 9th July 2019 (“MR on KYC”).

The POs have the following statutory duties:

1. Transaction Reports

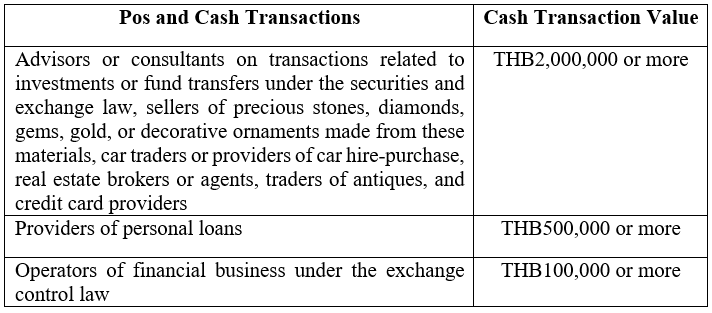

(1) The POs must report cash transactions in the table below to the AMLO within the end of the following month from the transaction date (Clause 2 of the MR on Cash Transaction);

(2) The POs must report any suspicious transaction to the AMLO within 7 days of the date on which the suspicion arose (Clause 7 of the MR No. 4).

(3) The POs must report each electronic money transfer or payment, including those received on behalf of customers, to the AMLO upon occurrence of such transfer or payment (Clause 7/1 of the MR No. 4).

(4) The POs must report to the AMLO any fact related to or could be beneficial for confirmation or cancellation of the facts related to any transactions that have already been reported to the AMLO under (1) to (3) above immediately upon occurrence of such fact (Section 16 of the AMLA).

2. Implementation of Know Your Customer (“KYC”) Procedures

The POs must implement and use KYC procedures to verify the identity of their following customers every time before commencing any of the transactions listed in the table under Clause 1 above (Clause 4 and Clause 5 of the MR on KYC):

(1) regular customers who have an established ongoing relationship with the POs unless the KYC have previously conducted;

(2) occasional customers for the following transactions:

• payment collection service with a value of THB500,000 or more;

• electronic money service or electronic money transfer service with a value of THB50,000 or more;

• any other transactions (single or multiple) with a cumulative value of THB100,000 or more.

3. Conducting Customer Due Diligence (“CDD”)

The POs must conduct the CDD on customers in the following scenarios (Clause 16 of the MR on CDD):

(1) upon establishing a business relationship with each of the customers unless they have already identified themselves;

(2) upon occurrence of any of the following transactions:

• payment collection service each with a value of THB500,000 or more;

• electronic money service or electronic money transfer service with a value of THB50,000 or more;

• any other transactions (single or multiple) with a cumulative value of THB100,000 or more;

(3) when it is reasonably suspected that a transaction may be involved with commission of a predicate offense, money laundering, or financing of terrorism or the proliferation of weapons of mass destruction;

(4) when there is a discrepancy or uncertainty regarding a customer’s identity.

LawPlus Ltd.

September 2024

To see the archive of our past newsletters and articles please click here.

AUTHOR

Partner | bangkok

Partner | bangkok Associate | bangkok

Associate | bangkok

The information provided in this document is general in nature and may not apply to any specific situation. Specific advice should be sought before taking any action based on the information provided. Under no circumstances shall LawPlus Ltd. and LawPlus Myanmar Ltd. or any of their directors, partners and lawyers be liable for any direct or indirect, incidental or consequential loss or damage that results from the use of or the reliance upon the information contained in this document. Copyright © 2016 to 2020 LawPlus Ltd.